By MIRIAM ACZEL

By MIRIAM ACZEL

Impact Investing to Achieve the SDG’s

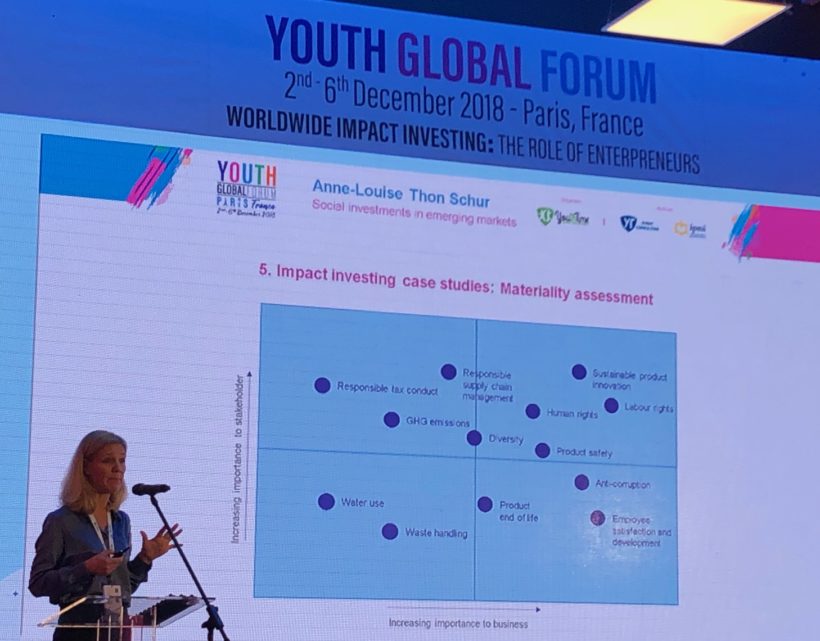

During the Global Youth Forum in Paris, Anne-Louise Thon Schur, the founder of SDG Invest and Head of Secretariat at The Global Impact Club (GIC) presented a masterclass on “Social Investment: Gaps and Opportunities in Emerging Markets.”

Anne-Louise’s mission is to prove that sustainable investments are indeed profitableinvestments. To this end, she leads two organizations for sustainable and impact investing: 1) SDG Invest, an investment fund categorized as an alternative investment fund (AIF) and is first global, sustainable equity investment fund in Europe that uses the SDGs as a proactive tool to invest in listed large cap. companies; 2) The Global Impact Club (GIC), a network that seeks to co-invest in impact programs.

A Platform to Meet Our Greatest Global Challenges

Anne Louise Thon Schur opened the workshop by explaining that the core of SDG Invest is rooted in the notion that “the World’s sustainable development goals (SDGs) are creating a platform to meet the greatest challenges of our times. Sustainability is at the heart of transforming the World’s economy. Business models must address societal challenges.”

UN’s 17 Sustainable Development Goals: A Framework for Impact Investing

Anne-Louise opened the masterclass by briefly outlining 10 examples of global challenges, such as the problem of food security, where “by 2050, our planet will have to feed 9 billion people… [which] will require large investments in innovative food production and a large decrease in global food waste,” and climate change, which will require both “large investments and innovative solutions to deliver on the 2-degree Celsius target decided in the Paris agreement.” Additional pressing issues include the need for inclusive economic growth. Rising inequality between countries, she explains, is “increasingly leading to social and political unrest,”. Another crucial challenge is the need for a sound global health system, as the phenomena of both population growth and demographic changes such as growing population and expanding urbanizationwill increase pressure on global health systems.

The Development of the UN Sustainable Development Goals

Anne-Louise next gave a brief overview of the development of the UN Sustainable Development Goals, discussing the Millennium Development Goals (MDGs) as the forerunner and “main developmental agenda driving global development between 2000 – 2015.” The MDG’s, which mainly focused on alleviation of poverty and diseases, led to achievements including a 50% reduction in those living below the poverty line, as well as a 50% reduction in the rate of child and maternal mortality. Moreover, the MSG’s led to a 40% reduction of new HIV infections, and over 2.6 people gained access to improved drinking water.

Following the MDG’s, the Sustainable Development Goals will run from 2015-2030. Anne-Louise explained that the SDG’s focus is alleviation of poverty and sustainable development, and that since September 2015, 193 countries have endorsed the universal agreement and their 169 sub-goals to be achieved by 2030.

Investigating Impact Investment: Case Studies

Anne-Louise next explained that the basis of sustainable impact investment is rooted in the notion of the “the triple bottom line,” first introduced by Sir John Elkington in his book ‘Cannibals with Forks: the Triple Bottom Line of 21st Century Business.’ The Triple Bottom Line (3BL) thus provides a framework for companies to measure their performance across allbottom lines that effect their stakeholders—rather than simply performing against an economic bottom line (or profit), companies should measure their performance against an environmental bottom line (or planet), as well as a social bottom line (or people). Thus, the triple bottom lines are identified through a ‘materiality assessment.’

Anne-Louise presented two different case studies to highlight common errors of social-entrepreneurship or positive impact start-ups,and gave participants the opportunity to evaluate the key differences between the two.

Goodwings Case Study

Her first case study was Goodwings, a travel booking engine that enables booking of flights, hotels and cars. Goodwings spends the money that other search engines spend on marketing, on charity (50 % of commission). They attract customers (businesses), through their partner NGOs and word-of-mouth. Companies can donate to one or more of Goodwings’ 60 partner NGOs, who all work with one or more of the SDGs. Moreover, Anne-Louise explained, they offer their clients (companies) annual impact reports on what their donations have achieved. Anne- Louise asked: “[T]aking into account the triple bottom line…would you say that Goodwings is a good impact investing solution? Why or why not?”

However, as Anne Marie explained, the issues with Goodwings’ model include the fact that in order to truly be an ‘impact investment,’ Goodwings would need to assess the “triple bottom line” of their 60 partner NGOs. Moreover, the “materiality of the travel business,” including the need to mitigate carbon dioxide emissions and ensure responsible supply chain management (such as labor and human rights issues), would need to be measured for the enterprise to be considered an impact solution.

Thus, Goodwings is not truly an impact solution because “they have no control over the hotelI choose—as a consumer, I want to know that if the hotel uses slave labor, how do they measure impact on the NGO’s?” So if a company is marketing themselves as an ‘impact investment’ it’s important to show consumers more of the impact, information about NGO’s that they work with, and the sustainability—including social impacts and human rights, as well as environmental impacts—of their supply chain.”

M-PAYG Case Study

M-PAYG was the second case study. M-PAYG has developed a combined hardware and software solution that allows “bottom of the pyramid (BoP) customers to buy small-scale installations of renewable energy (RE) products, for individual households.” Thus, the customer pays for the solution in small installments, which are matched with their monthly alternative cost of kerosene (lamp oil), using mobile money. As Anne-Louise explained, over 1.2 billion, one in five people in the world, do not have access to electricity. Without access to affordable electricity, most families in rural areas must derive energy from generators or lamp oil (kerosene) which is hazardous, unhealthy and cost up to 37% of household income.”

So what are the differences between M-PAYG and Goodwings? M-PAYG’s impact can be summarized as having a large customer base (profit), allowing for a reduction in greenhouse gas emissions (planet) and providing both an increase in local jobs created and an increase in consumer health, productivity (people).”

Impact Investing Guidelines

As Anne-Louise explained, the UN SDG’s power is that it’s an innovative model, which allows players to come together in a new and different way. However, she continued, a social start-up should not be treated differently than any other company, but must still have a viable business plan.

Anne-Louise ended her informative talk with several guiding questions to help get started in impact investing:

- What is your sustainability drive? (which challenge are you addressing and why?)

- Is another company making the same or a better impact?

- What positive impact does the company have?

- What negative impacts is the company trying to avoid through its business plan?

- Does it have real potential for impact or is it merely ‘SDG-washing’?

- Does the company have a sustainable business plan (management procedures and KPIs) for the 3BL? – as she explained, “please work on your numbers because if you don’t know numbers, controlling your cash flow, is the difference between success and failure.”

- Does it address the “triple bottom line” (as opposed to only addressing the financial profit)?

Miriam Aczel is a President’s Scholar PhD Candidate at Imperial College London’s Centre for Environmental Policy. Her research focus is on international energy science and policy, with a focus on mitigation of environmental and health impacts of shale gas. She is also co-founder and co-director of the Amir D. Aczel Foundation for Research and Education in Science and Mathematics, a nonprofit working in Cambodia.

Miriam is Director of Communications and blog editor for Leaders in Energy.

Leave a Reply