By MIRIAM ACZEL

By MIRIAM ACZEL

Last month, I represented Leaders in Energy at the 2018 Youth Global Forum in Paris. The Youth Global Forum brought together over 100 participants, experts, and young entrepreneurs from all over the world for a jam-packed three days of discussing ideas and solutions to pressing global problems. One keynote speaker, Robert Rubinstein gave a very interesting presentation on myths and misunderstandings related to impact investing. Rubenstein is the founder and creative thought leader behind TBLI, Triple Bottom Line Group based in Amsterdam. The work has expanded and now includes organizing TBLI Conference, an international conference on socially responsible investment, advising the European Commission (DG Social and Employment), and running a consultancy firm.

Rubinstein introduced his workshop by stating that “impact investing is an overnight success after 25 years.” He explained that there are several enduring myths and misconceptions regarding impact investing and its potential for producing significant financial, social and environmental benefits.

Impact Myths

Some of the key myths regarding impact investing include the notion that it is “charity, and therefore has zero returns”; it is “money-losing”; has no potential for economies of scale; there is no long-term track record for impact investing; it is prone to bad management and that it is too risky.

These misconceptions, Rubinstein says, are compounded by other myths regarding conventional investment, including the erroneous assumption that all investment managers hit their benchmarks; that Private Equity funds earn 30%; and that Hedge Funds earn 30%.

Rubinstein therefore underscored that we need to challenge these myths–challenge the investing status quo—because “sound investing will lead to significant and lasting economic, social, and environmental benefits” but only if it is ‘sound investing’ that takes into account all three bottom lines. Long term, investing only against a financial bottom line will not lead to lasting returns.

So how do we tackle these myths?

Rubinstein explained that “behavioral change is not the challenge, access is the challenge—access to investors. Therefore, if you can get access to people, opportunities to speak to them, you can change their mind as the case in favor of the triple bottom line makes financial sense. Impact investing sells itself.”

The main challenge, according to Rubinstein, is ignorance about impact investing, compounded by challenges in gaining access to investors. Rubinstein argued that too many people push only the “moral imperative,” and while there is a clear ethical and moral case for investing in products and businesses that are environmentally conscious and sustainable, there is also a strong financial case. Thus, when speaking to investors, it’s important to “focus on the money flows,” showing how impact investing has clear potential for growing wealth, in addition to environmental and social benefits. Furthermore, in addressing mainstream investment misconceptions, Rubinstein explained that the financial sector has been forced to pay over 3-4 hundred billion dollars in legal fees and fines for “the risky business has been the status quo for the past several years,” including investing in polluting and environmentally degrading industries. Thus, he explained, “instead of putting all your money in polluting investments and being forced to pay fines and fees, you can put all of it to create value for people and profit.”

What is ESG and what can it offer?

ESG, or Environmental, Social and corporate Governance, refers to the three main factors in measuring the sustainabilityin addition to the ethical impact of an investment, and these criteria can empower us to better determine the future financial performance of companies, by looking at more than simply economic profit.

People + Planet + Profit

ESG looks at Social Equity, Environmental Quality, and Economic Prosperity. In this sense, Rubinstein explained, “ESG adds social and/or environmental value to external stakeholders, while increasing value to shareholders.”

ESG questions whether, to maintain profitability, your products or services:

- Worsen Social and Environmental Balance

- Maintain Social and Environmental Balance

- Improve Social and Environmental Balance

Rubinstein then contextualized the value of ESG with current drivers and the “new economic model.” For example, China, he explained, will reach the US’s level of consumption by 2031. With increasing growth in emerging markets, the linear line of growth is not possible—because of limits on resources and impacts on the environment. Therefore, the only way to keep that growth increasing is with resource efficiency on a massive scale.

The main drivers, according to Rubinstein, are:

- Emerging Markets Resources

- Resource inefficiency

- Wealth holders integrating philanthropy and investment

- Financial crisis and aftermath for financial sector-$300b

- Staff and clients looking for purpose

- Regulation

- Stakeholder pressure

- Students and employee demand on employers and endowments

- Wealth management engagement with clients around impact

- Self-Interests and the Business Case

These drivers, he explained, are one of best ways to engage clients—using “self interest and business case,” and making clear the financial growth potential of employing ESG.

ESG Growth

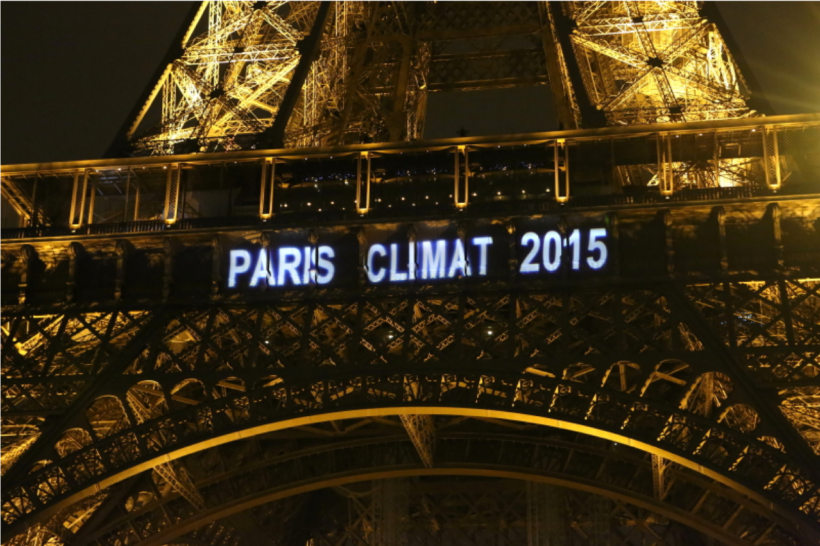

Rubinstein explained that the key areas of growth are energy, food and water. However, a problem, is that “the media covers the least important thing – what the Dow did today. But you don’t do that—that’s like watching the score board while you play tennis. You don’t do that—you play the game! So media should cover more than what the markets do, and instead report on more than just the financial bottom line of companies and businesses.” Fortunately, however, he said that following the Paris Climate Agreement, there has been significantly more interest in ESG and ‘green investing.’ Another benefit of impact investment, he explained, is that “in the illiquid side, you can engage with stakeholders on something they’re passionate about.”

Simple Green Investment Ideas

Rubinstein then discusses some simple investment solutions, such as community banks and public transportation infrastructure. “98% of banks in America are small family owned banks—community banks—and you can invest in that space,” he explained. Public Transport Infrastructure, according to Rubinstein, “ticks all the boxes—it’s low carbon, can allow investors to de-carbonize portfolios; has a long track record of success; offers steady cash flow; is a low technology risk; can be scaled up easily; and offers great yields.”

Not a Niche Market

Rubinstein concluded his workshop by summarizing some of the recent milestones, such as Carbon Tracker, UNPRI, the Equator Principles, the Montreal Pledge, the Carbon Disclosure Project, among others, which “all helped change the mindset of the impact investor.”

Essentially, he said, ESG and green investing/socially responsible investing “is not a niche market—it’s just a party and we’re early. But getting there early is an advantage, because you have first access to the bar, to the food, by the time everyone arrives, you’re having a great time.” Thus, he said, as consumers and as investors, we need much more long-term focus.

Quoting Yoda, he concluded, “Do or do not.. there is no try.”

Miriam Aczel is a President’s Scholar PhD Candidate at Imperial College London’s Centre for Environmental Policy. Her research focus is on international energy science and policy, with a focus on mitigation of environmental and health impacts of shale gas. She is also co-founder and co-director of the Amir D. Aczel Foundation for Research and Education in Science and Mathematics, a nonprofit working in Cambodia.

Miriam is Director of Communications and blog editor for Leaders in Energy.

Leave a Reply